Introduction

In recent years, the use of artificial intelligence (AI) to improve delivery, productivity and profitability has become a focus for businesses across a broad swathe of industries.

In the property market, AI has the capacity to transform the way residential buyers and property investors source, evaluate and secure properties, by making important information - including insights and analysis that were once near unimaginable – both accessible and immediate.

Historically, in the absence of undertaking time-consuming, manual analysis of various, disparate sources of information, many residential buyers and investors were reliant on word-of-mouth, circumstantial evidence and the subjective views of industry professionals when seeking to understand the market dynamics of a given area. AI algorithms, including those used by our team, help radically enhance efficiency and reduce reliance on the 'finger in the air' approach, by pulling data from across the internet and public repositories instantaneously, producing fully tailored and detailed reports that are both individualised and also easy to understand.

We aim to be at the forefront of this technological evolution, utilising cutting-edge AI solutions to empower both seasoned investors and residential buyers alike. Set out below are nine ways AI can empower UK property buyers.

1. Sourcing Properties:

In days gone by, potential buyers would need to manually reach out to individual estate agencies to obtain lists of available stock. This was cumbersome, time consuming and inefficient. The advent of property portals such as Rightmove, Zoopla and OnTheMarket has vastly improved this process, allowing buyers to search a collated list of all publicly listed properties in a given area, filter them and view them online.

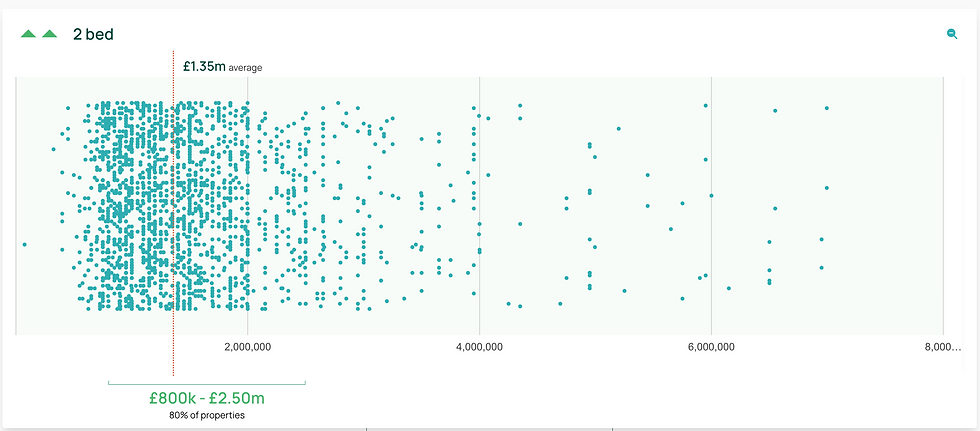

Recent developments in AI have taken things a step further – allowing us to collate a comprehensive database of available properties for any UK area by ‘scraping’ this information from across each of the above portals. The software can then be utilised to plot each property on a graph, instantly cross-referencing its price against other properties of a similar size, and demonstrating where potential value can be found.

Further, AI algorithms can carry out real-time scanning across all website-based portals and refine the results by a very broad range of strategies. For example, AI can be used to how buyers only those properties available only to cash buyers, properties which are HMO licensed, properties which have been slow to sell, properties which are cheap per square foot, properties which are currently tenanted, properties which are chain-free, and many others.

2. Understanding Capital Appreciation Trends:

Through advanced algorithms, we can now also use AI to provide invaluable insights into capital growth trends. Historically, buyers would be reliant on broad price trend indices, often produced infrequently and relating to large areas (such as 'North West'. By collating vast quantities of live house price data from various sources, including repositories such as the UK Land Registry, we can now use AI algorithms to obtain immediate and highly-tailored pricing trend data into fully customised areas, whcih are as large or small as a buyer wants.

By leveraging this technology, property buyers who previously lacked access to such comprehensive and specific market trend data can now make more informed decisions, based on easy to digest graphics which are relevant to much smaller, more bespoke areas, and in a much quicker timeframe. This democratisation of data empowers buyers with the knowledge needed to navigate the market with confidence and optimise their investment potential.

3. Understanding Average Prices per Square Foot:

It is good practice for buyers to consider whether a given property exceeds, or falls below, the typical asking price per square foot within its location. In years gone by, understanding typical asking prices per square foot in a given area would require a buyer to rely on selling agents, or to carry out detailed diligence independently, which could be very time consuming.

AI-powered investment software now enables buyers to obtain an immediate assessment of the general price per square foot in an area, both in terms of current asking prices and confirmed sold prices over a fixed look-back period. These results can be further refined to enable the buyer to understand the average price per square foot based on the number of bedrooms a property has, or the property type (e.g. detached, terraced). This knowledge can prove highly valuable for purchasers in their negotiations with selling agents, empowering them to secure favourable deals.

AI analytics can also be used to determine whether properties typically achieve a higher or lower price per square foot depending on their size, which can be used to inform, for example, developers’ decisions as to whether larger properties might be suitable for splitting into flats, or whether a strategy of merging smaller properties into larger properties might be more profitable.

4. Understanding Rental Trends:

In the absence of AI-driven analytics tools, property investors would need to have either detailed local knowledge of the area in which they were looking to invest, or would have to rely on local agents to provide estimates of expected rents and rental yields. While taking such steps remains advisable for responsible investors, it can prove time-consuming and laborious. Further, rental estimates based on the views of local agents could potentially lack a comprehensive grounding in data, and are open to a degree of subjectivity, limiting investors’ ability to make well-informed decisions based on objective data.

Today, by analysing vast amounts of data in seconds, AI can accurately assess average rents in any defined area and break down this information by both house size and type, producing immediate visibility. This enables buyers to gain a detailed understanding of rental market dynamics quickly. Properties can be excluded from the investment process more rapidly, while properties that pass an initial screening through AI enhanced analysis can then be further diligenced with the help of local agents.

Furthermore, AI can identify trends and patterns to suggest which size of houses perform most strongly in a particular area, providing buyers with valuable insights to guide their investment strategies. Used correctly, AI-driven analysis streamlines the process of obtaining rental estimates, reinforces the advice of local agents and enhances buyers' decision-making capabilities.

5. Indexing and Analysing Comparable Sold Properties:

One of the most important elements for any buyer to understand is how the proposed purchase price compares with recently sold, equivalent properties. By sourcing comparable recently sold properties, buyers can more accurately gauge the market value of their target properties, minimising the risk of overpaying.

The ease with which buyers are now able to obtain such data has been greatly enhanced in recent years. Technology-enhanced software solutions can now be used to quickly identify recently sold properties, which can be collated, compared and contrasted with properties that are of interest to buyers. Sold properties can be displayed in graph form, demonstrating average prices per square foot in an area and effectively ‘ranking’ the target property against previously sold properties. The ability to quickly and efficiently collate lists of comparable properties, and further break them down by size, price per square foot, number of bedrooms and other amenities (e.g. gardens, proximity to train stations etc) can prove highly valuable for buyers in understanding the local market’s pricing trends and the extent to which they might be over or underpaying.

6. Understanding Local Supply and Demand Dynamics

For investors and buyers alike, understanding the supply and demand dynamics of the area in which they are interested is critical. For residential purchasers, it is important to understand the number of suitable homes which are currently available to buy, as well as how long it typically takes for those homes to sell (known as market ‘turnover’).

For investors, it is equally important to understand the rental turnover, being the number of homes typically rented per month in a given area, versus the up-to-the-minute number of available properties for rent. These metrics ultimately dictate whether house prices and rents are likely to rise, fall or remain stable.

We can now use AI algorithms to determine the turnover of properties for both the sales and rentals market in defined areas. This helps residential buyers and investors quickly understand whether their preferred area is operating as a buyer’s market or a seller’s market, and whether it constitutes a renters market (with oversupply) or a landlord’s market (with undersupply).

7. Understanding the Type of Stock Available:

AI can also be used to understand the volumes of supply of certain types of housing, categorised by physical size, number of bedrooms or type. This enables investors to tailor their investment strategies to align with market demand, optimising their portfolio composition.

For example, if an area has a low number of three-bedroom houses, and a large number of two-bedroom houses, it is possible that the three-bedroom houses could be in higher demand. If the price per square foot of a three-bedroom house in such an area is equivalent to a two-bedroom house, this may represent good value from an investment perspective. These initial investigations can be verified on the ground with local sales or lettings agents.

8. Standalone Valuations

The need to rely solely on selling estate agents or mortgage brokers to value a property is also being eroded by the growth of AI. Multiple AI tools can now be used to produce an objective estimated value for a property, based on inputs from the potential buyer such as location, property type, age, number of bedrooms, condition and other factors (e.g. energy efficiency, amenities, etc.). Used alongside the valuations provided by professional valuers, this can be a powerful tool in the arsenal of buyers, and indeed sellers who may be looking for an efficient way to gain an understanding of what their property may be worth. While algorithmic calculations are not yet sufficiently accurate to replace human-lead assessments, the quality of the algorithms, aided by machine learning and increasing data sets, is enhancing the capacity of AI to provide more precise valuation assessments.

9. Understanding Area Demographics:

AI algorithms also allow us to delve into area demographics, offering accessible and immediate insights into population dynamics, socio-economic factors, and lifestyle preferences that impact both property demand and value. Buyers can benefit from AI tools to quickly draw data from Office for National Statistics, The Electoral Commission, Ordnance Survey, Ofsted, the UK Police, PlanningPipe, the Food Standards Authority and others, to help assess deprivation levels, health, education, employment categories, average household incomes, average age structures and even political leanings within defined areas of their choosing.

Further information on the level of planning activity, crime rates, the quality of local schools, volumes of green space and even the food hygiene standards of local restaurants can be drawn from official public sources almost instantaneously. Obtaining such data would have historically been extremely time consuming, requiring individual enquiries of each of the relevant public bodies.

Summary

The integration of AI into property investment has the potential to usher in a new era of efficiency, accuracy, and assuredness in property buying. The democratisation of data via AI-driven algorithmic solutions, which makes objective information more accessible and bespoke, means residential buyers and investors can navigate the property market with greater confidence, knowing that every decision is backed by data-driven insights.

About Oxstone

Oxstone is a market-leading UK property sourcing company and purchaser's agency. We leverage the latest AI-enabled property sourcing and investment analysis software and our strong network of connections across the UK to source, analyse and secure excellent residential and investment properties for our clients, including off-market properties that are not available to the general public.

We also offer our clients deep market expertise, superior transaction management throughout the buying process and connections to recommended service providers. Our expert guidance through each step of the buying process ensures our clients are among the best placed in the market to succeed in their relocations or investments.

Comments